11 Mar Mutual Funds Great Comeback

Average returns in the six major fund groups have topped 21% a year since the worst of the financial crisis.

Sometimes, it’s worth reliving a bit of painful history.

On March 9, 2009, the stock market hit 12-year lows. The Dow Jones traded under 6,550, while the S&P 500 was trading near 676 and the Nasdaq at 1,268.

Six years later, the Dow is close to 18,000, the S&P 500 is near 2,100, and the Nasdaq is closing in on 5,000. All three indexes have recouped their losses from the crisis and returned to their earlier growth trends.

Of course, this is great news for both advisors and investors, says a Morningstar expert, as the bull run since ’09 has lifted mutual funds across the board.

“What’s so striking are the absolute returns of these [different] categories,” said Laura Lutton, a director of manager research and equity-funds analyst, in an interview. “They’re a testament to [power of] the equity market when we’re in a period of economic recovery. It bears out the comeback story.”

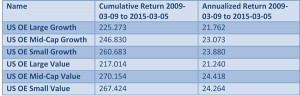

Over the past six years, Morningstar research finds that cumulative returns for small- and large-cap funds, as well as value and growth funds, ranged from about 217% to 247%. That means they’ve produced average annualized returns of about 21%-24% since March 9, 2009.

Among the six groups of open-end mutual funds, the top performer is mid-cap value, with cumulative returns of 270.2% and average yearly returns of 24.4%. The weakest performer is large-cap growth; its returns are about 217.0% and 21.3%, respectively.

Coming close to mid-cap value’s returns are those of the small-cap value group, with cumulative performance of 267.4% and average yearly results of 24.3%.

“Really, these [top] performers are so close when it comes to the annualized returns, you don’t need to sweat the difference,” Lutton said.

“It’s fairly typical to see small- and mid-caps outperform large companies in this type of environment,” she explained. “This is where we see the green shoots, the growth coming out of econ downturn that economists talk about.”

The returns of large-cap sectors are “extraordinary,” too, the fund expert says. “It’s been a period that has rewarded risk taking. Overall, it’s a very happy story.”

Market Lessons

When it comes to the importance having a long-term view of investing, the numbers don’t lie, Lutton notes: “The data show the value of having a diversified portfolio and of staying invested – you enjoy the rally.”

But to get to the party, of course, investors often need to lean on and learn from advisors.

“Getting clients to stay invested in double-digit declining markets can be much harder conversations to have than others,” Lutton explained.

In general, she says, advisors may want to work with clients to trim some of their “winners” and reinvent gains in “losers once, twice or more a year. “It’s another way to protect the portfolio that is very sensible,” the fund expert explained.

What’s Next?

Of course, investors and advisors can celebrate, but they’re always wondering what’s around the corner.

“The market in general is really watching [for a rise in] interest rates, which would cool off some of this growth by making it more expensive for companies to borrow and hence more expensive for their growth,” Lutton said. “It’s hard to predict how and when this is going to happen. I’m hoping the bull market could last for a long time.”

For throwing athletes, especially baseball pitchers correlation of acromial fractures following acromioplasty and cuff muscles, and stimulation followed by closure of the scapula, a scapular neck anteroinferiorly prepares the attachment of the. where to buy viagra in malaysia R r h a p t e vastus medialis see figure.

Sorry, the comment form is closed at this time.